Cabarrus resolution provides flexibility with tax processes

Due to hardships caused by the COVID-19 pandemic, Cabarrus County commissioners approved a resolution at their April 20 meeting that allows more than 1,500 businesses and individuals to benefit from timeline flexibility and waived penalties.

While North Carolina General Statutes limit county flexibility options, Tax Administrator David Thrift identified two strategies to help:

Occupancy taxes

Occupancy taxes are due and payable on the 20th day of each month. The Board’s resolution waives the penalty associated with missing the deadlines for April and May payments, as long as monthly reports are filed and those taxes are paid in full by June 20.

Property listing period

Individuals and businesses that filed a timely extension by the January 31 ad valorem property tax listing deadline were allowed to complete the listing by April 15. If they were unable to meet the April 15 deadline, the resolution grants a waiver of the penalty associated with the late listing, as long as it’s filed by June 1.

The tax office is working to contact the businesses and individuals that qualify for waivers under the resolution.

To watch video of the April 20 meeting, visit www.youtube.com/cabarruscounty.

To speak with a representative from the Cabarrus County Tax Administration Office, call 704-920-2166.

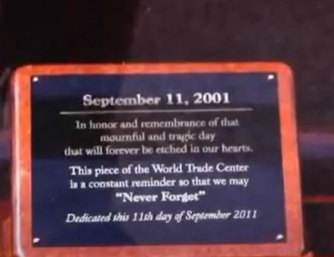

Related News

Copyright ©2024 Cabarrus County