Cabarrus revaluation notices mailing this week

Cabarrus County is mailing revaluation notices to property owners in Cabarrus County, and residents will have 30 days to file appeals with the Cabarrus County Tax Administration Office.

The new property values are effective Jan. 1, 2020. Tax bills with the updated values will mail to property owners in July and are due in January 2021.

About revaluations

Every four years, Cabarrus County reviews property values based on market values and economic conditions to bring assessed values in line with the worth of the property as of January 1 of the revaluation year. The revaluation process brings equity among property values and ensures the value of any given property is consistent with neighboring properties.

The tax bill for each property will depend on the combination of the assessed value of the property, and the tax rate set by the Cabarrus County Board of Commissioners and municipal boards in June.

2020 revaluation data summary

Due to activity and changes in the real estate market over the past four years, some properties have increased in value, some have decreased and some are virtually unchanged.

At this point, the County anticipates an increase of more than 15 percent in real property values for the County as a whole. Because each property is different and the revaluation includes all residential and commercial properties, this number does not necessarily reflect what individual property owners will see in their revaluation notice.

The revaluation process

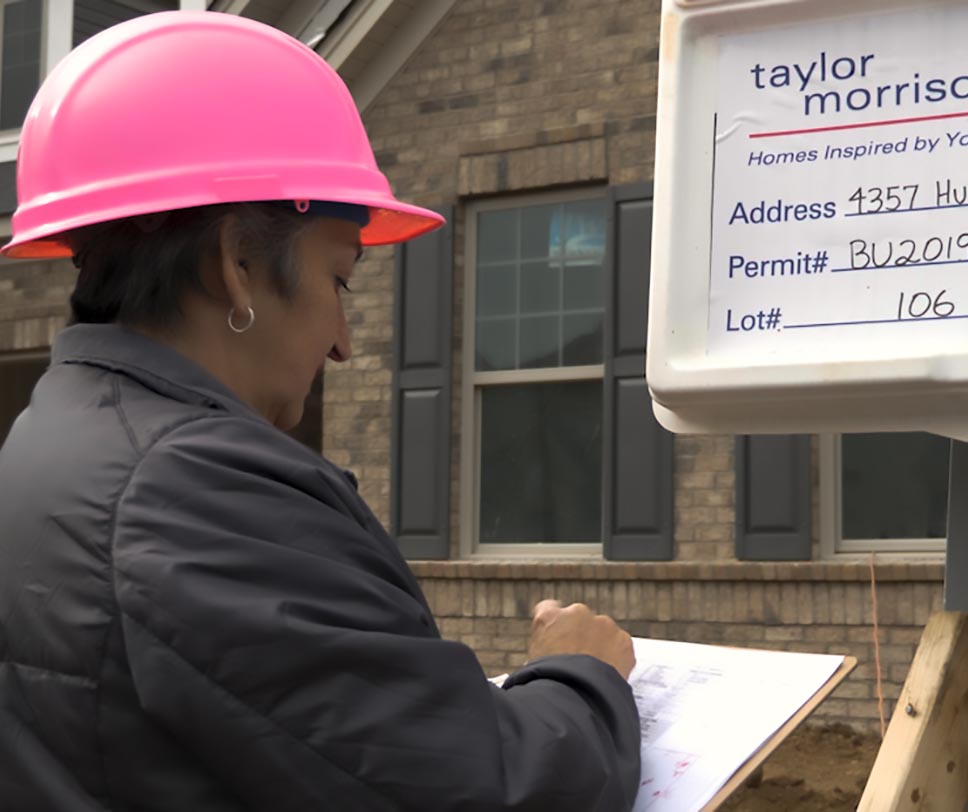

County real estate appraisers review properties by analyzing data collected using actual field visits and aerial images of properties to estimate fair market value – or the price a willing seller may receive from a willing buyer. In cases where property owners make improvements or other changes occur to the property, appraisers visit the property to evaluate its features.

The process of evaluating property is ongoing and depends largely on communication between the property owners and the tax administration office. To help avoid discrepancies in property value and prepare for revaluation, the County mails property owners a listing document each January. The document informs owners of their responsibility to report any changes to the property. The County works with property owners to address potential discrepancies through the revaluation appeal process.

Each revaluation notice includes an appeal form. Property owners may submit their appeal in writing to the Cabarrus County Tax Administration office within 30 days of receiving the notice or file the appeal online at www.cabarruscounty.us/appeal.

The appeals process “in my opinion, is one of the most important parts of this project,” said Tax Administrator David Thrift. “It’s our opportunity to communicate with taxpayers. It’s an opportunity to address any concerns they may have.”

Revaluation workshop

Residents interested in learning more about Cabarrus’ revaluation process are encouraged to register for Gov 101: The 2020 Reval. Gov 101 includes interactive presentations, panels and demonstrations that break down the complexities of the revaluation process. Connect with revaluation experts and learn what they do to ensure a fair and equitable tax values in Cabarrus. The free workshop is Friday, March 6, 8 a.m. to 3 p.m. at the Cabarrus County Government Center (65 Church Street S, Concord).

Class size is limited and registration is required by March 4. To learn more or to register, email outreach@cabarruscounty.us, call 704-920-2336 or register at http://bit.ly/gov101cabcoreval20.

County budget process

The Cabarrus County Board of Commissioners began the FY2021 budget process with a retreat the last weekend of February. Property owners will have opportunities to participate in the ongoing budget and tax rate process by attending public workshops and meetings beginning in April.

The County started on the 2020 revaluation process in 2018. The Board of Commissioners held a public hearing on the 2020 Schedule of Values in September 2019 and adopted the schedule at its October regular meeting.

The County has provided thorough information on the revaluation process on its website, www.cabarruscounty.us, social media and on Cabarrus County TV.

For more details about revaluation, visit www.cabarruscounty.us/revaluation.

See a rundown of FAQs at https://bit.ly/cabcorevalfaq.

Email revalinfo@cabarruscounty.us or call 704-920-2126 with questions.

Related News

Copyright ©2024 Cabarrus County